What is Small Business Accounting Software?

Small business accounting software is a digital tool designed to help small business owners organize, track, and manage their financial transactions, expenses, and income. From invoicing and payroll to budgeting and tax preparation, small business accounting software automates many aspects of financial management, saving time and reducing the risk of errors associated with manual bookkeeping methods.

Key Features of Small Business Accounting Software

Modern small business accounting software offers a wide range of features and capabilities to meet the diverse needs of small businesses, including:

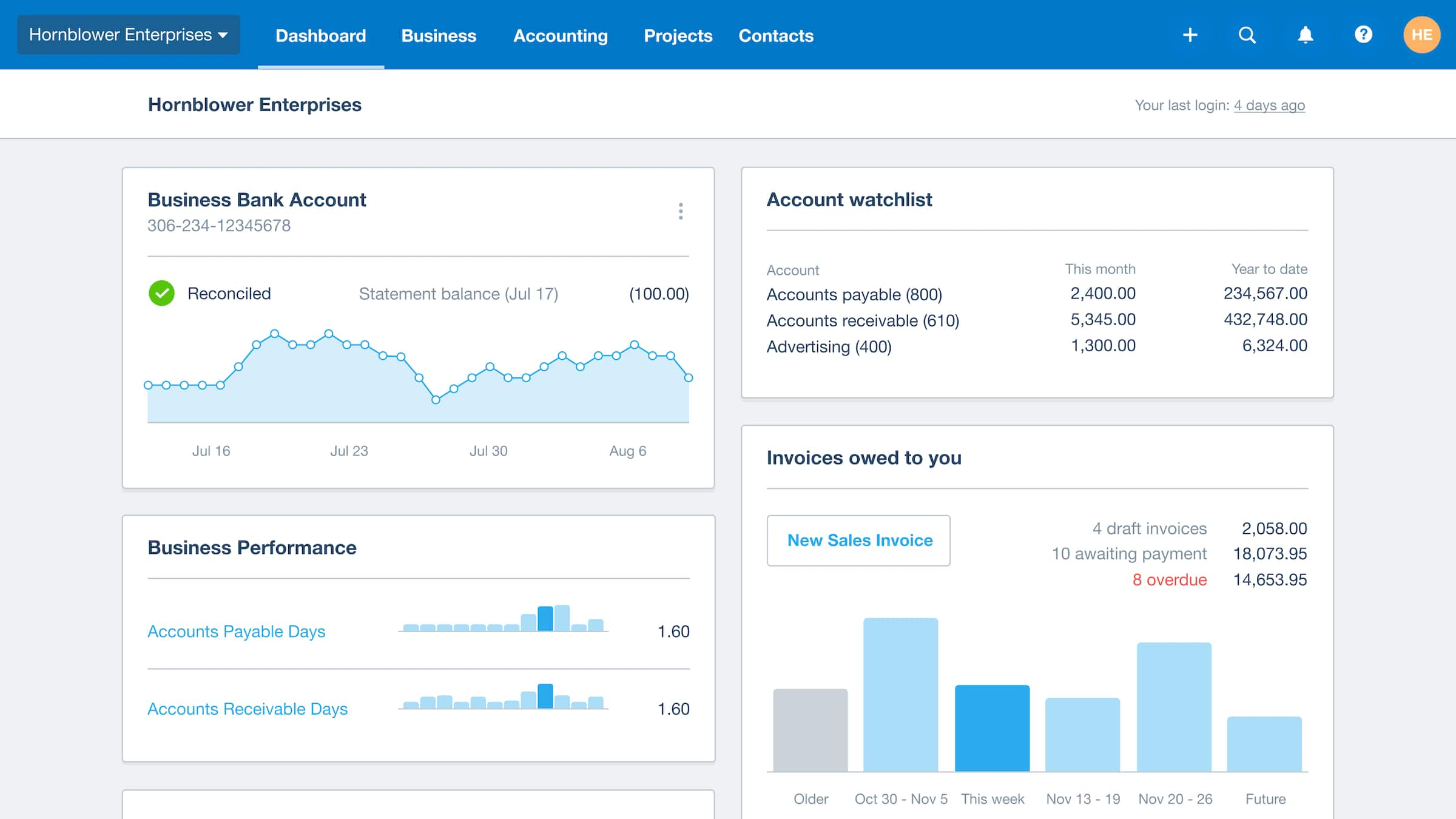

- Invoicing: Small business accounting software allows users to create and send professional invoices to clients and customers, track payments, and manage accounts receivable.

- Expense Tracking: Users can track and categorize business expenses, including purchases, bills, and recurring payments, helping to monitor spending and manage cash flow effectively.

- Bank Reconciliation: Software Chiefs.com/ automates the process of reconciling bank transactions, ensuring that financial records are accurate and up-to-date.

- Financial Reporting: The software generates a variety of financial reports, including balance sheets, income statements, cash flow statements, and profit and loss statements, providing valuable insights into business performance and financial health.

- Payroll Processing: Some small business accounting software solutions include payroll processing capabilities, allowing businesses to calculate and process employee wages, deductions, and tax withholdings accurately.

- Tax Preparation: Small business accounting software simplifies tax preparation organizing financial data, generating tax reports, and facilitating the preparation and filing of tax returns.

Benefits of Small Business Accounting Software

The benefits of using small business accounting software extend beyond simple bookkeeping. Some of the key advantages include:

- Time Savings: By automating repetitive tasks and streamlining financial processes, small business accounting software saves time and frees up resources for other aspects of business operations.

- Accuracy and Compliance: Small business accounting software reduces the risk of errors associated with manual data entry and ensures compliance with tax regulations and accounting standards.

- Financial Visibility: The software provides small business owners with a clear and up-to-date view of their financial performance, allowing them to track key metrics, monitor trends, and make informed decisions.

- Cost Savings: Small business accounting software is often more affordable than hiring a dedicated accountant or bookkeeper, making it a cost-effective solution for small businesses with limited resources.

- Scalability: As businesses grow and evolve, small business accounting software can scale to meet their changing needs, accommodating increased transaction volumes, expanding operations, and evolving regulatory requirements.

Choosing the Right Small Business Accounting Software

When selecting small business accounting software, consider factors such as:

- Features and Functionality: Assess your business needs and choose software that offers the features and capabilities you require for your specific financial management needs.

- Ease of Use: Look for software with an intuitive and user-friendly interface that is easy to navigate and use, especially if you’re new to accounting software.

- Integration: Ensure that the software integrates seamlessly with other tools and systems used in your business, such as payment processors, e-commerce platforms, and point-of-sale systems.

- Cost: Evaluate the cost of the software, including subscription fees, licensing fees, and any additional costs for add-on features or support services.

- Customer Support: Choose a software provider that offers responsive customer support and resources such as tutorials, training materials, and user forums to help you get the most out of the software.

Conclusion

In conclusion, small business accounting software is a valuable tool that empowers small business owners to take control of their finances, streamline financial processes, and make informed decisions to drive success and growth. By automating bookkeeping tasks, providing valuable insights into financial performance, and ensuring compliance with tax regulations, small business accounting software helps small businesses thrive in today’s competitive landscape.